ANALYSIS: ICVCM’s Core Carbon Principles for the VCM

Today the Integrity Council for Voluntary Carbon Market released the full Assessment Framework as part of their Core Carbon Principles, providing more guidance on how to improve the credibility and quality of carbon credit projects at both the carbon program and credit category level to maximize the full climate potential of the voluntary carbon market. AFF’s Manager of Environmental Markets Calvin Tran breaks down the news and what it means for the future of the market.

Worth around $2 billion in 2021, the value of the voluntary carbon market is estimated to grow to over $50 billion by 2030 – the most rapid expansion of its development in recent history. While participants see the voluntary carbon market as a promising mechanism for corporations to invest in natural climate solutions, critical questions of integrity and challenges in program design are still top of mind for those looking to maximize the climate potential of the market.

What defines “high quality” in a carbon project? How do you compare carbon credits from one crediting program to another? As our scientific understandings of carbon evolve, how will markets evolve with them? These questions must be addressed in order to scale the voluntary carbon market to the size needed to realize its full potential in unlocking climate action. The launch of the Core Carbon Principles (CCPs) by the Integrity Council for Voluntary Carbon Market (ICVCM) promises to answer these questions and more.

THE CORE CARBON PRINCIPLES

The ICVCM is an independent governance body that grew out of the Taskforce on Scaling Voluntary Carbon Markets (TSVCM) in 2020.

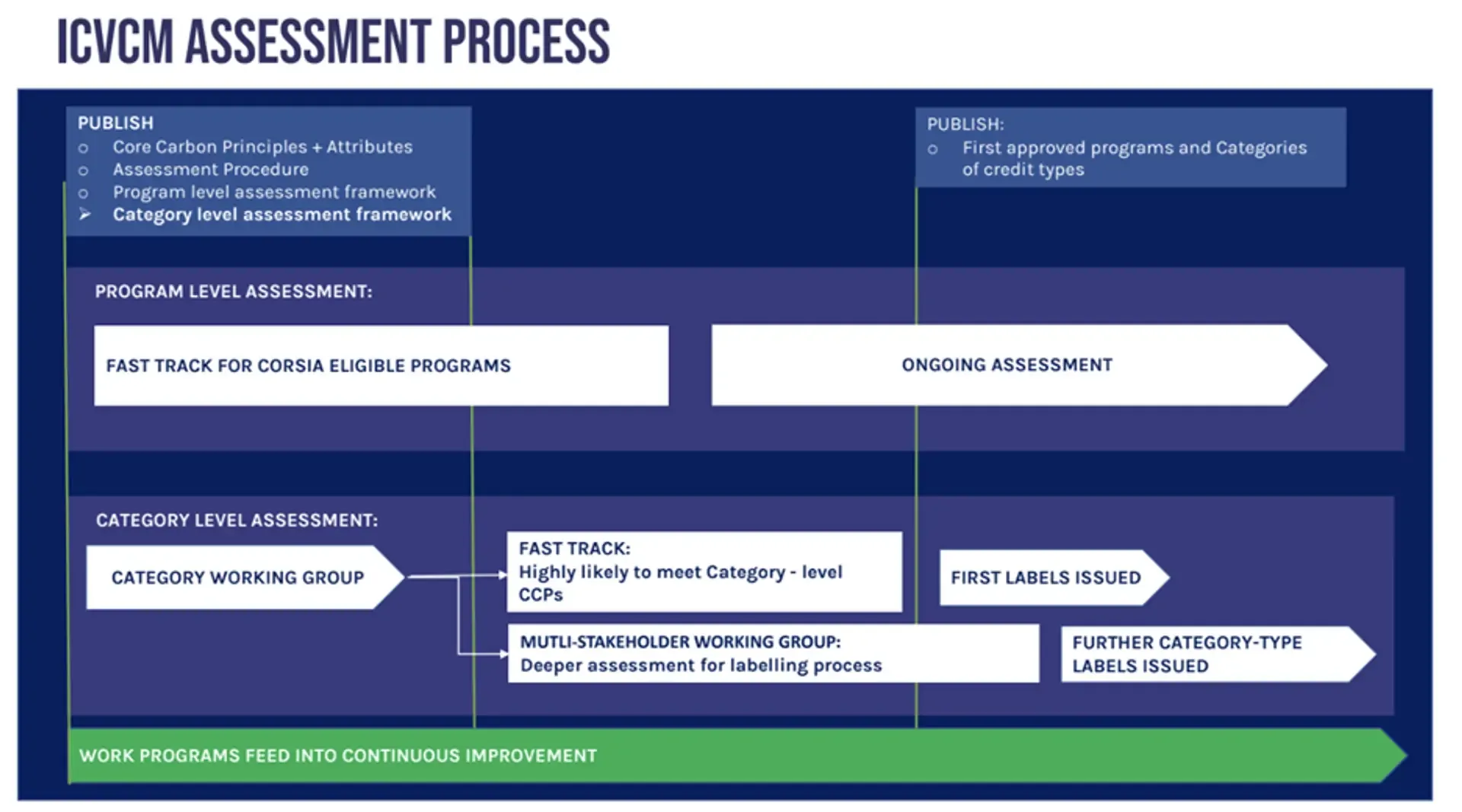

“Build integrity and scale will follow'' is the motto of the ICVCM – and this motto is championed through the Council’s Core Carbon Principles (CCPs). The CCPs aim to provide global guidelines and shared definitions for what makes a high-integrity carbon credit. Earlier this year, the Council initially launched the Principles, along with a Program-Level Assessment Framework, which provides guidelines to carbon-crediting programs such as Verra’s Verified Carbon Standard. The release today includes new Category-Level details within the Assessment Framework, which sets out requirements for assessing categories of carbon credits like enhanced weathering or forestry sequestration projects. Together, the two releases represent the collective work produced from a global multi-stakeholder process over the course of a year. The American Forest Foundation along with hundreds of other organizations provided extensive feedback during the ICVCM’s public consultation period.

WHAT DOES THIS RELEASE MEAN?

The Core Carbon Principles represent a “standard of standards.” Up until this point, project developers have followed guidelines and criteria set by the carbon crediting programs they were housed under. For example, a forest carbon project under Verra’s Verified Carbon Standard could meet its VCS requirements, and a similar forest carbon project under the Gold Standard could meet the Gold Standard’s requirements. The problem is that there is no way to compare the two similar projects in a congruent way. This presents a challenge to buyers and investors of carbon credits. Without a way to compare projects across standards, the market is fragmented, and buyers are left in a difficult position when making purchasing decisions.

Enter the CCPs. The CCPs set a standardized benchmark for high-integrity carbon credits and builds stronger trust throughout the voluntary carbon market. With the CCPs, programs and project developers have a clear set of guidelines to distinguish and develop high-integrity carbon credits. This gives buyers more assurance that the projects they fund are making a genuine impact on emissions.

A carbon credit will only receive the CCP-approved label once both its carbon-crediting program and applicable carbon credit category criteria are met. This two-tiered approach represents a strategy to incorporate integrity at every level while also counteracting market fragmentation across programs and registries. Buyers and investors will have more confidence in identifying and pricing high-integrity carbon credits once CCP-eligible programs and CCP-approved credit categories begin appearing on the market. With this heightened sense of transparency across carbon projects, funding can more easily flow to the project developers and communities making the biggest impact on the ground.

WHAT’S NEXT?

According to the ICVCM, the initial assessment phase for carbon-crediting programs and carbon credit categories comes next. Carbon-crediting programs are expected to be able to label the first CCP-approved credits by the end of this year.

The work of the ICVCM does not end here, and new workstreams are being developed through multi-stakeholder work programs to continuously strive for higher clarity, innovation and ambition. These work programs are designed to inform the future evolution of the Assessment Framework and develop new attributes for CCP-approved credits. These attributes will not be required for CCP-eligibility, but rather identify other high-integrity elements and qualities to allow buyers to purchase credits that better match their preferences.

The work on developing the next iteration of the Assessment Framework begins after the release of this version and will include multi-stakeholder work programs. The first revision process for the CCPs and the Assessment Framework is expected to launch in 2025 and be ready for implementation in 2026.

Source: ICVCM

A healthy and functioning high-integrity voluntary carbon market is essential if we are to mobilize the climate finance needed to stay on a 1.5-degree pathway. As the VCM constantly evolves and as our understanding of carbon science continues to develop, we now have a set of documents that can evolve with it. In this view, the Core Carbon Principles are a welcomed addition and may just be the catalyst needed to usher in the next great expansion of the voluntary carbon market.

Related Articles

July 7, 2023

The VCMI Claims Code and What It Means for Family Forests

Late last month, the Voluntary Carbon Markets Integrity Initiative (VCMI) launched their Claims Code of Practice, which aims to heighten integrity of the carbon credits sold on the voluntary carbon market. The Claims Code provides companies with a rulebook on how and when to utilize carbon credits and the claims they can make following their use.

June 5, 2023

FEATURE: Keep on Moving – Dynamic Baselines Seen Driving Accuracy in Forest Carbon Accounting

In the context of accusations of widespread over-crediting in the voluntary carbon market (VCM), one emergent accounting approach could tackle some of the challenges with auditing of forestry projects, offering real-time and dynamic monitoring of climate impact via remote sensing technologies.

December 18, 2025

Improving Wildlife Habitat with the Family Forest Carbon Program

For many landowners, spotting a fox, songbird, or other wildlife on their property is one of the highlights of spending time on their land. In this post we look at some examples of management practices you may see in your FFCP forest management plan and how they help create the ideal conditions for certain wildlife species.