A Snapshot of Trends Among Carbon Buyers

The voluntary carbon market is growing exponentially as companies across sectors step up to address their carbon emissions. By providing carbon credits for the private sector, the voluntary carbon market plays an essential role in bridging the finance gap between public and private climate action while also helping companies reach their sustainability targets. However, the guidance for buying credits remains unclear, and many companies are left without direction when it comes to understanding the ever-evolving carbon markets.

For carbon buyers navigating this new market, it is valuable to see how peers are evaluating projects and making progress on their carbon reduction journey. Earlier this year, the American Forest Foundation hosted a webinar with Greenbiz on Ensuring High Integrity When Purchasing Carbon Credits to discuss how to evaluate carbon credits and highlight our carbon project, the Family Forest Carbon Program. There, we surveyed the audience on how they are making decisions on carbon credit purchases, asking:

What do you look for when partnering with a carbon project?

Where do you look for guidance?

Where is your company in meeting its carbon reduction goals?

Of the more than 400 webinar attendees, 64 participated in this survey. Their answers give us a snapshot into the voluntary carbon market’s evolution. Take a look at how the market is thinking and what conversations are being held today on what the future of the voluntary carbon market will look like.

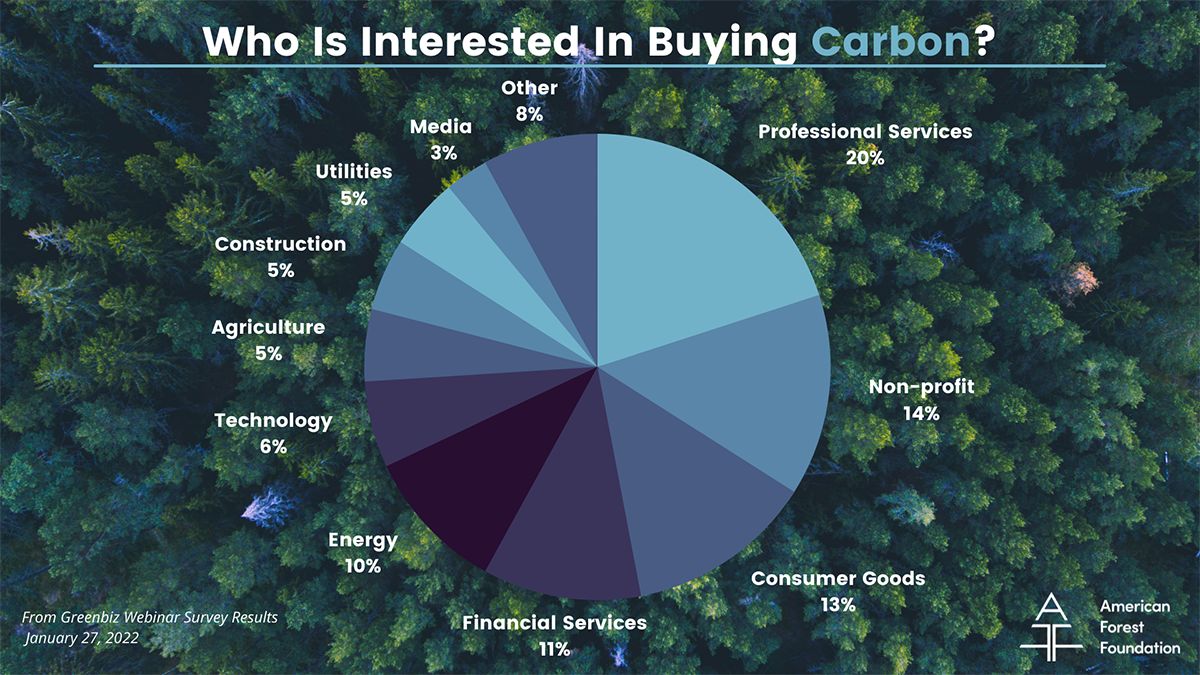

Interest in Carbon is Accelerating Across Sectors and Industries

Companies from many different sectors are entering the carbon market and seeking credits as a solution to their carbon reduction goals. As long as the buyer has truly positive intentions for carbon reductions, and is simultaneously committed to all feasible action to reduce their own emissions, the voluntary carbon markets are inclusive and will support the heightened ambition of various sectors.

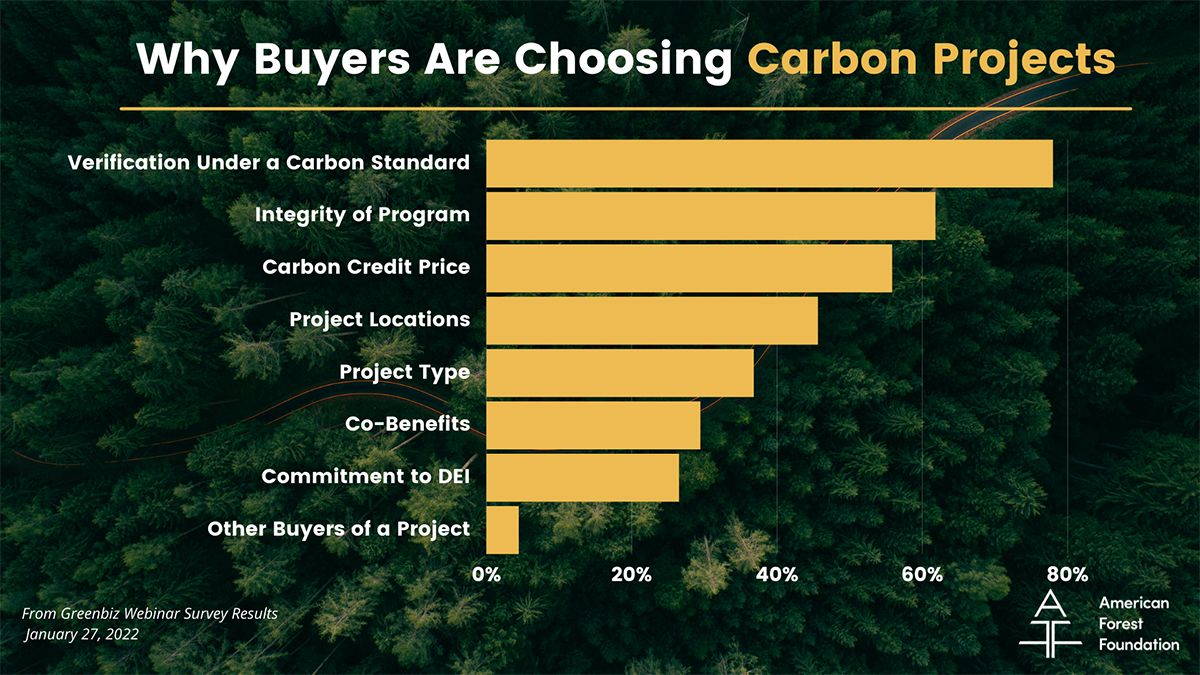

Carbon Quality and Program Integrity Are Top of Mind

When choosing a carbon project, buyers are interested in MORE than just the credits. Companies are shopping for quality and the quality assurances that come with projects verified under high-quality and globally recognized standards, such as the Verified Carbon Standard (VCS). These were the top factors influencing buyers’ decisions with 78% of respondents looking for verification under a carbon standard and 62% evaluating the integrity of the carbon program.

A sizable percentage of buyers also value a project’s societal and economic impacts with 45% evaluating projects based on their location, 29% on the co-benefits, and 26% on its commitment to diversity, equity, and inclusion. When purchasing credits, buyers are looking at the full package from the climate mitigation impact to the effects on local communities.

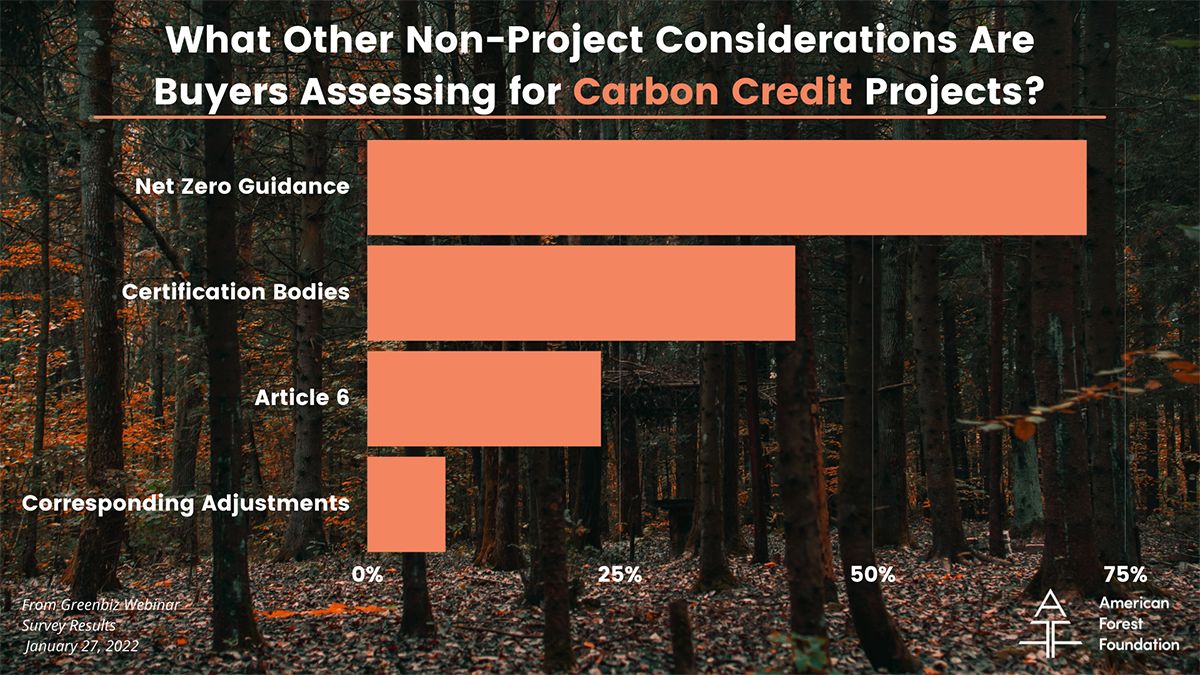

Outside of a project’s attributes, buyers are keeping up-to-date on global standards from governing bodies and experts. The Net-Zero Standard was the most prevalent resource for buyers with almost three-quarters of participants.

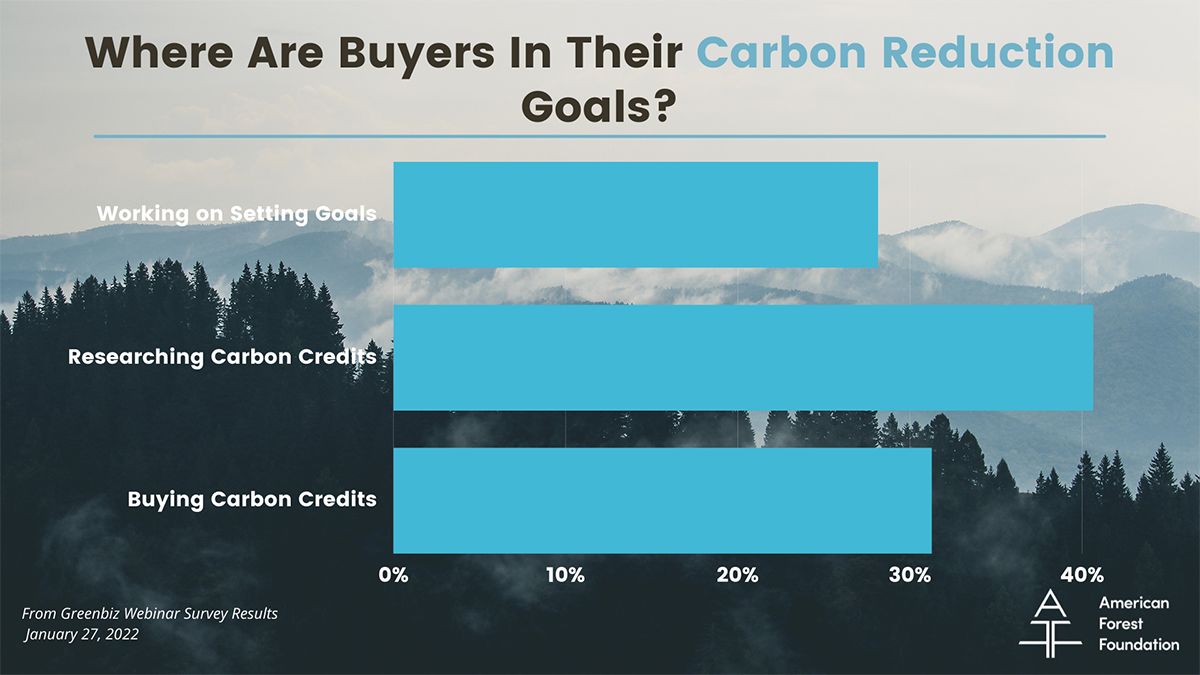

It’s Still Early, But Smart Actors are Getting In Now

Attendees were evenly divided across the carbon reduction journey. 31% of participants are already purchasing credits, locking in lower prices now before the carbon market continues to grow. However, other participants are in the earlier stages, either currently researching and considering their options (40%) or setting their climate mitigation goals (28%).

The Wrap Up

These results give us an exciting look at the voluntary carbon market’s evolution. As the market grows and becomes more accessible, more and more industries are considering and seeking out carbon credits to address their residual emissions in line with evolving best practices. With many options for carbon projects, buyers are also looking beyond price, demanding high-integrity and verification under a carbon standard. While the carbon market seems daunting and new, many companies are already purchasing credits and partnering with high-integrity projects to meet their climate goals.

Wherever you are in your climate journey, the Family Forest Carbon Program is here as a resource in your climate mitigation work. We are excited to advance the integrity of carbon credits through our new methodology under Verra’s Verified Carbon Standard and offer a new high-integrity option in the carbon marketplace. If you’re ready to start a conversation about purchasing carbon credits, reach out to John Ringer, Director of Carbon Market Development at ffcp_partnerships@forestfoundation.org and partner with us as we grow this innovative solution.

As you are researching and setting goals, we can also offer you helpful information and guidance. Sign up for the monthly Family Forest Carbon Program Newsletter to receive the latest news and resources to support your carbon reduction goals.

Related Articles

April 7, 2025

Forester Spotlight: Mac MacKenzie

We’re excited to spotlight Mac MacKenzie, a dedicated forester with the Family Forest Carbon Program (FFCP) who is passionate about sustainable forestry and conservation.

December 11, 2024

AFF Awarded $5 Million to Support Family Forest Owners

The American Forest Foundation (AFF) announced today that the U.S. Department of Agriculture (USDA) Forest Service has awarded the organization $5 million of Inflation Reduction Act (IRA) funds through its Forest Landowner Support (FLS) program.

November 19, 2024

Family Forest Carbon Program Receives BBBe Rating from Carbon Ratings Agency

This week, the American Forest Foundation (AFF), a nonprofit organization that empowers family forest owners to create meaningful conservation impact, announced its receival of a ‘BBBe’ rating of its improved forest management (IFM) practices by carbon ratings agency BeZero – the highest of the agency’s public ratings of this project type in the United States.